-

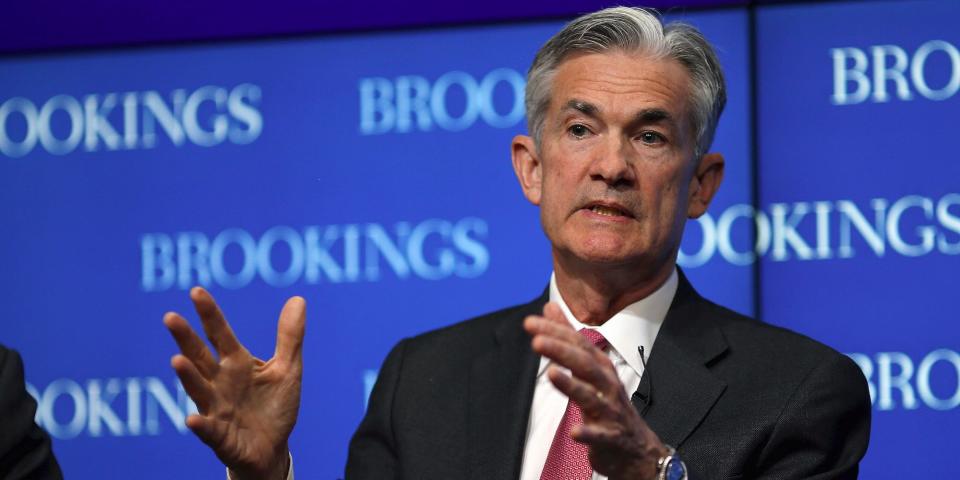

Stocks could be exposed to more Fed-induced turmoil, according to DataTrek Research.

-

This is partly because the Fed is unlikely to stop the quantitative tightening regime.

-

The Fed has slashed its balance sheet significantly over the past year, which could affect stocks.

The stock market is reacting badly to the interest rate hike in August after major bond yields have spent most of this year heading lower in response to expectations that the Federal Reserve is close to raising interest rates.

According to DataTrek, investors should prepare for more turbulence ahead.

This is because even after the Fed stops raising interest rates, there is another policy tool that the central bank can use to continue to tighten monetary policy: quantitative tighteningthe central bank’s practice of shrinking its balance sheet to dry up liquidity in the markets and tighten financial conditions.

Moreover, the Federal Reserve is running out of balance sheets at a time when the US is issuing massive amounts of new debt, with plans to sell $1 trillion in Treasury notes this quarter alone.

As of last week, The Federal Reserve has already slashed its balance sheet by about $700 billion From the first quarter of 2022 to $8.2 trillion from $8.9 trillion. Balance sheet tightening was one of the factors that weighed heavily on stocks last year, with S&P 500 falls 20% To achieve its worst performance since 2008.

“By refocusing market attention on stubbornly high inflation, the Fed is implicitly telling us that it is comfortable with maintaining its current pace of balance sheet reduction for some time,” Nicholas Colas, co-founder of DataTrek, said in a note Thursday.

Colas added that the Fed is unlikely to stop the quantitative tightening regime even after raising interest rates, and markets should be prepared for disappointment when it comes to a possible “Fed situation.”

“The thought that the Fed would step in to fill the breach, either by easing the balance sheet cut or returning to bond buying, seems wishful thinking at best,” Colas said. “The current slow-moving long-term interest rate shock has a way to go, in our view, and equity markets will struggle as it develops. It all fits with our belief that we are in for a dirty few weeks ahead.

The yield on the 10-year Treasury note traded at 4.28% on Wednesday, hitting a 15-year high.

Read the original article at Business interested